Pt. 1 City Budgets w/Autumn: Budget Basics & Lingo

By Autumn Hensiek-Fain

Hey, my name is Autumn. I've lived in Corpus my whole life, and have always been afraid to admit how little I knew about our city's budget.

Doing research into a slew of documents, PDFs, and statistics the city had online didn't really quite solve the vagueness of my understanding. So, with the help of a coffee from Lucy's and some of my closest comrades, I set to work.

I'm going to understand this budget, and so are you.

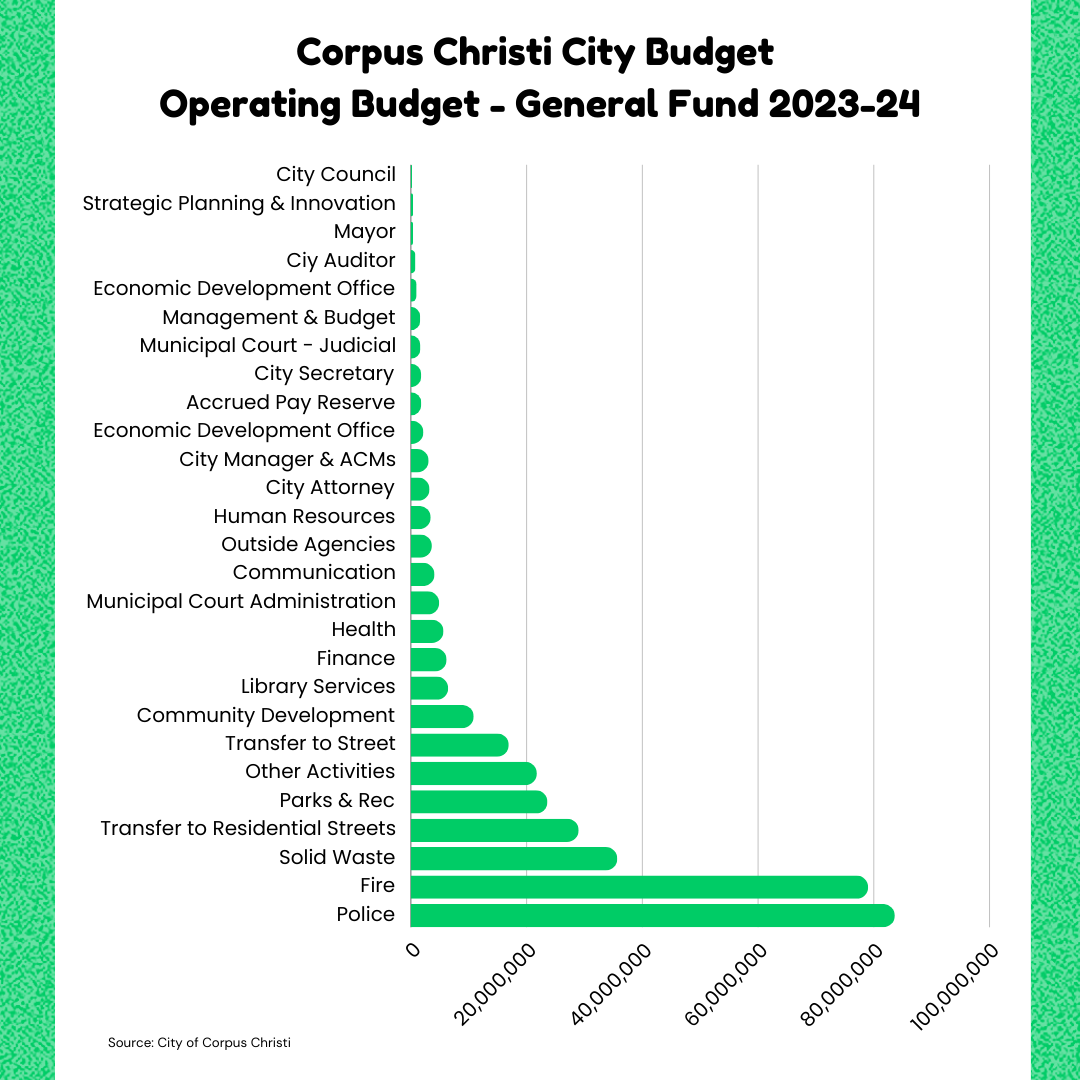

We know, roundabout, what the city budget funds. You know, police, fire, sidewalks, roads. But looking into figures and trying to decipher what it all means is genuinely as exciting as watching paint dry.

As we watch our elected officials work to start using tax dollars to fund the most heinous of crimes, both in our backyards and overseas, it's more imperative than ever that we understand exactly what our money is funding and how it's allocated and spent in Corpus Christi and beyond.

@thechismecollective "As we watch our elected officials work to start using tax dollars to fund the most heinous of crimes, both in our backyards and overseas, it's more imperative than ever that we understand exactly what our money is funding and how it's allocated and spent in Corpus Christi and beyond." - @autpuff

♬ original sound - Chisme Collective 🍉 - Chisme Collective 🍉

We need to be able to talk to others about how our city prioritizes its budget and what services and individuals it deems worthy of investing in.

Government documents are dense, they're difficult to understand and easy to give up on by design. If our budgets were designed by the people and for the people, what do you think they would look like?

To me, it's pretty simple. A budget should tell you who's in charge and how and when you can participate. It should explain each different fund, what the revenue source is and what city department handles it. It should decode all of the jargon, lay out definitions that communicate goals, background information and reasons why funds are budgeted for these services and projects. It should present spending in an easy to understand way, by department, by service, all in proportion to the total budget, and it should compare budgets from previous years to see how spending has changed over time.

Comparing city budgets, restructuring funds, it can be tricky. Oftentimes, funds can't be moved from one pot to another, and a lot of funding comes from separate state and federal budgets, which have their own rules and restrictions.

But the more that we understand all of those regulations and how our city's spending the funds that our tax dollars give them, the more empowered we are to influence that spending and demand the changes that we all want to see.

@thechismecollective Pt. 2 - Dive into budget lingo w/ @autpuff The City of Corpus Christi will host community input sessions for the proposed FY 2025 Budget, with sessions scheduled in each Council District. Check out the dates & times here: https://www.chismecollective.com/understanding-corpus-christis-city-budget-with-autumn/

♬ original sound - Chisme Collective 🍉 - Chisme Collective 🍉

Budget Lingo

Well, folks, if we're going to understand the budget we need a primer to the language. Starting with the fact that the city of Corpus Christi actually has not one, but two different budgets.

Our capital budget, think things like roads, sewer systems, water supply networks, which is based on multi-year capital improvement plans and supported through different types of funding.

Our operating budget, which is our day to day costs of running the city, including salaries for city workers. That's going to be funded primarily through local property and sales taxes. Operating budgets are usually separated even further into specific groups. Our general fund is the primary day to day fund. That's where those city employee wages and benefits are going to end up, and usually are the largest expense from this fund.

We have a special revenue fund which restricts funds to a specific purpose. And our internal service fund, which centralizes all costs to help develop rates that would charge all departments for any unexpected costs.

Like, let's say we need a whole new fleet of fire trucks. The funding would come from this specific fund. Usually, taxes are where the largest share of revenue, aka money, comes from.

But not all revenue sources are alike. Some are set aside for specific purposes and some are restricted to those specific purposes. Property taxes are taxes that are paid by those who own real estate.

The amount of property tax someone pays depends on the property's value and the tax rates that are charged by the local government.

There's other taxes, too; sales taxes, gas taxes, and some business taxes.

We also have things called proprietary fees, usually user fees and charges. The intent here is to be self-supporting, i.e., not relied on by taxes or grants but rather fees charged for services by the city.

Some examples of these are things like permitting fees that you might pay when you rent a building, have a special event, or need another type of permit.

Local governments are usually major landowners in the community. Think parks, government offices, airports, seaports, community centers. In fact, the Richard M. Borchard Regional Fairgrounds in Robstown is owned and operated by Nueces County.

When the government leases publicly owned land to private organizations or businesses, the rental fee goes to fund other services.

There's also something called user fees. These are charges of use for public facilities or infrastructure. Things like your bus fare, trash pickup fees, docking charges at the airport, water and sewage charges.

Then we have our fines and grants. Fines are things like parking tickets, citations for safety and fire violations and our federal and state grants are, again, funding for specific purposes.

You did it.

You learned the budget lingo.

Next, we dive into the City of Corpus Christi's proposed budget for the 2024-25.

To be continued ...

The City of Corpus Christi will host community input sessions for the proposed FY 2025 Budget, with sessions scheduled in each Council District.

- District 1 – Monday, August 5, at Brewster Street Icehouse, 1724 N. Tancahua Street

- District 1 – Wednesday, August 21, Railroad Seafood & Brewery, 15701 Northwest Boulevard

- District 2 – Wednesday, August 7, The Terrace Restaurant Bar, 3741 S Alameda Street

- District 3 – Thursday, August 8, at Muelle 37, 4918 Ayers Street

- District 4 – Thursday, August 15, at In The Game Funtrackers, 9605 S. Padre Island Drive

- District 4 – Monday, August 19, at The Waterline at Doc's, 13309 S. Padre Island Drive

- District 5 – Tuesday, August 14, at Del Mar College Oso Creek, 7002 Yorktown Boulevard

Use the interactive map to find your district. https://www.cctexas.com/council-members.