Pt. 3 City Budgets w/Autumn: Corporate Tax Breaks & Budget Shortfalls

By Autumn Hensiek

Highlights:

- Peter Zanoni and the “business” of running a city

- What the Industrial District Agreement (IDA) vote means for the city's budget

- City adopts Capital Budget, delays vote on Operating Budget

Picture this: A proposed city budget with $9.1 million less than the previous year and a city council blaming the shortfall on two small benefits to residents:

- A lack of revenue from the phasing out of the city’s street user fee.

- A statewide increase to the homestead exemption for homeowners.

Since budget talks kicked off earlier this year, the Corpus Christi City Council failed to factor into discussions missed opportunities of creating a massive new revenue stream for Corpus Christi residents.

Missed Opportunity

Last month, the City Council renewed and extended by five years the Industrial District Agreements established in the 80s between the city and those who, at the time, ran the local fossil fuel economy. These industrial districts were created to protect industrial properties from annexation, which means they can operate outside city limits without paying property taxes, sales taxes and franchise fees. Those who enter into these agreements with the city instead give Payments in Lieu of Taxes, or PILOT payments, to the City of Corpus Christi.

Although the new PILOT payment rates agreed upon this year will yield $5 million more annually throughout the duration of the 15-year agreements, revenue projections presented to city council in 2022 show annexation could result in at least $7 million annually from one IDA holder: Bootstrap Energy. Bootstrap Energy is a bitcoin mining operation.

About 80 industrial companies are currently benefiting from IDA’s with the city.

To Annex or Not to Annex

Leading up to the council’s vote on IDA’s, residents spoke overwhelmingly in favor of annexing the properties that currently benefit from industrial district agreements. Others also lamented a lack of fairness, a loss of potential revenue for the City, concerns with the corporations’ daily operations and the effects they have on public safety, health and the environment.

District 2 city councilwoman Sylvia Campos, spoke against the agreement during the August 27, 2024 city council meeting, stating: “These industries, the corporations have been getting tax breaks for at least 40 years. They expect the City to continue to subsidize (them). It’s these types of dollars that are slipping through our fingers right now.”

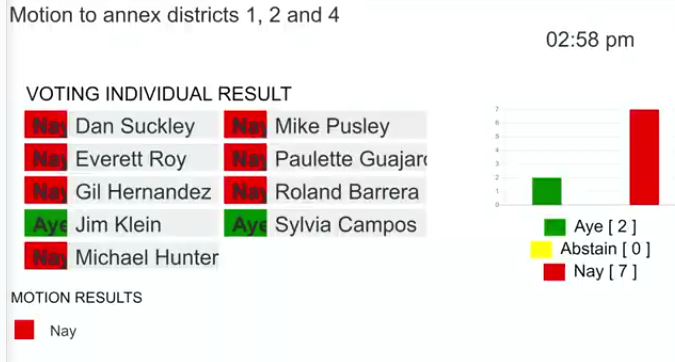

The agreement passed 7-2, with only Campos and Jim Klein voting in favor of annexation.

Now that the vote has passed, this new 15-year long IDA will go into effect after the previous IDA expires on Dec. 31, 2024.

Reframing Corporate Tax Breaks & Their Consequences

It seems like a contradiction to blame budget cuts on minor benefits to residents.

Taking into account the City’s own math, the resident benefits blamed for budget cuts – phasing out the city’s street user fee and a statewide increase to the homestead exemption for homeowners – this year average between $100-200 per household [Link, slide 15].

District 3 councilman Roland Barrera was quoted by KRIS-6 defending the IDA’s, stating: "The consternation that the public typically has is the statement that ‘(Corporations) pay their fair share.’ Something to consider is that once we get to their fence line, we have no responsibility to their streets. They have their own waste management. They have their own security force.”

The Corpus Christi Fire Department and the Corpus Christi Police Department are often seen at industrial accidents like leaks, spills and other hazards that have taken place at facilities with active IDA agreements.

Barrera is also wrong in saying that these incidents are magically contained to the fence line that separates residents from industrial sites. They do — and have — affected residents, wildlife and the local environment.

Barrera’s sentiment has been echoed by city manager Peter Zanoni on multiple occasions. In listening to Zanoni speak, it’s evident that he prides himself in running the city like a private business instead of a public institution.

While this type of thinking may seem more efficient, we know that under capitalism, efficiency typically means profit for a small number of wealthy stakeholders.

Profit-Driven Cities?

Profit shouldn’t be something we ask our government to turn out; a surplus of funds isn’t something we should strive towards unless it’s being poured into the maintenance costs that come with running a coastal city, as well as bolstering the public services that many taxpayers rely on to survive.

As taxpayers, we deserve our own IDA's and tax breaks, not corporations. The City should prioritize finding new revenue streams from the industrial expansion they have enabled in the Coastal Bend to maintain and grow social programs and services that benefit residents.

It’s obvious to most of us that we need a far larger societal profit than long-term tax breaks for corporations that perpetually pollute and destroy the natural Gulf Coast.

A healthy population with access to healthcare, housing and other social support is, in this writer’s opinion, the most beautiful display of wealth a city can hold.