Column: Why Corpus Christi grew outward while inner city neighborhoods stagnated

The history of Corpus Christi’s ‘Trust Fund Ordinance’

By Eli McKay

Highlights:

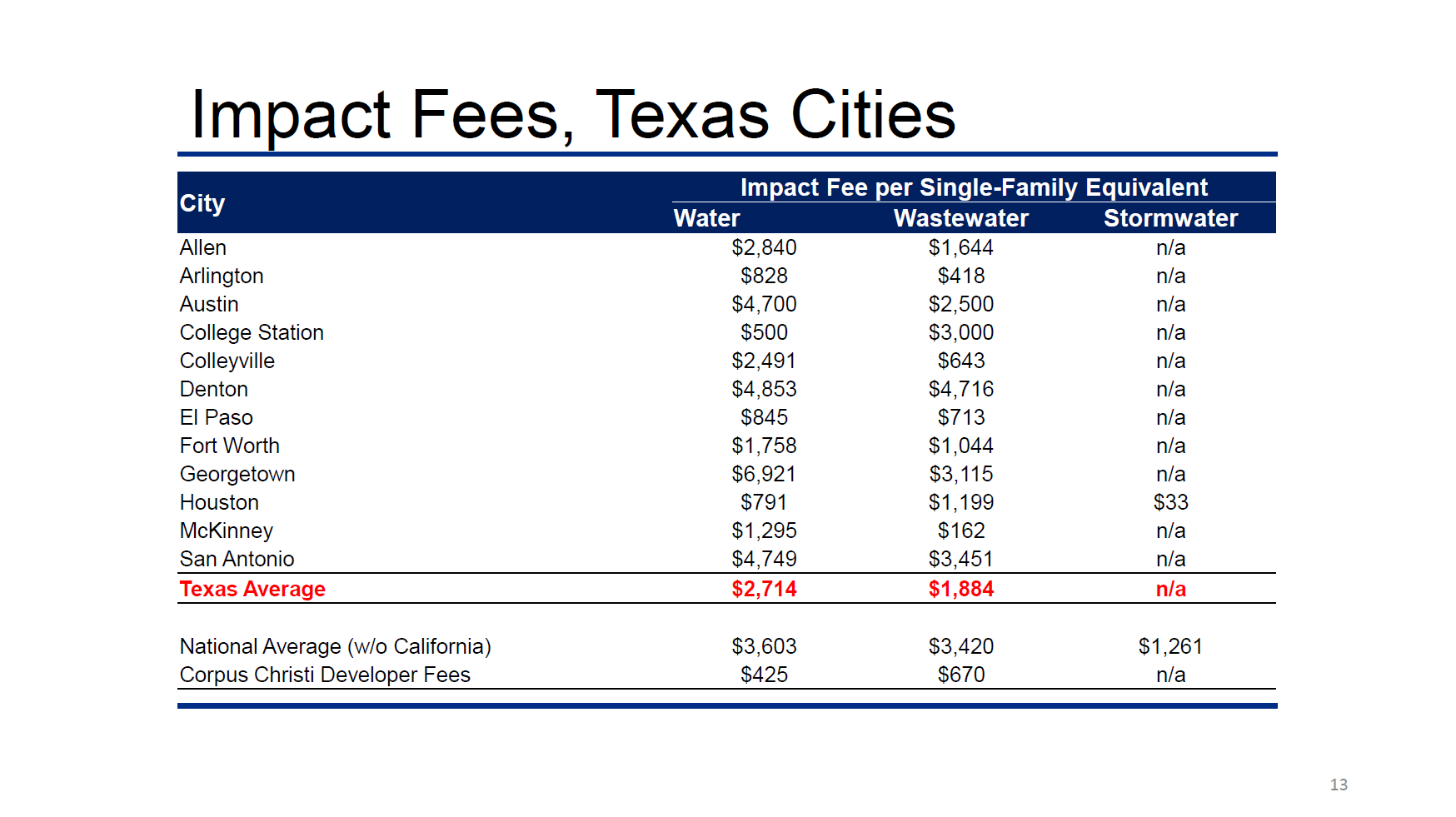

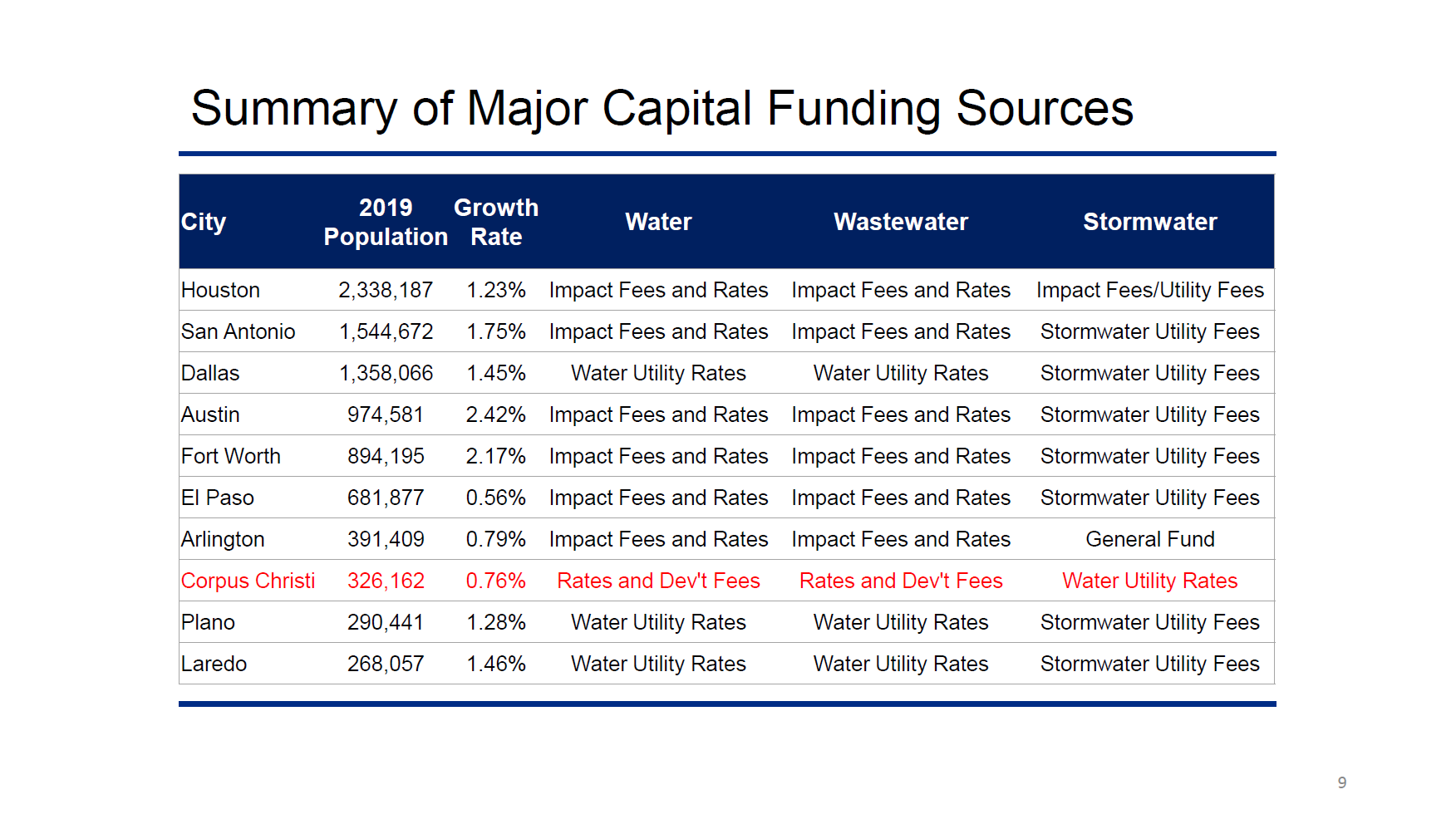

- Every other Texas city larger than Corpus Christi charges developers impact fees because they’re an industry standard.

- Corpus Christi instead uses what city staff call the “trust fund model,” which was created by developers to guide the city’s growth in the early 80s.

- Consultants have told the city council multiple times that the trust fund model has inadvertently shifted the cost burden of the city’s growth onto the taxpayer, but the trust fund ordinance remains in place today.

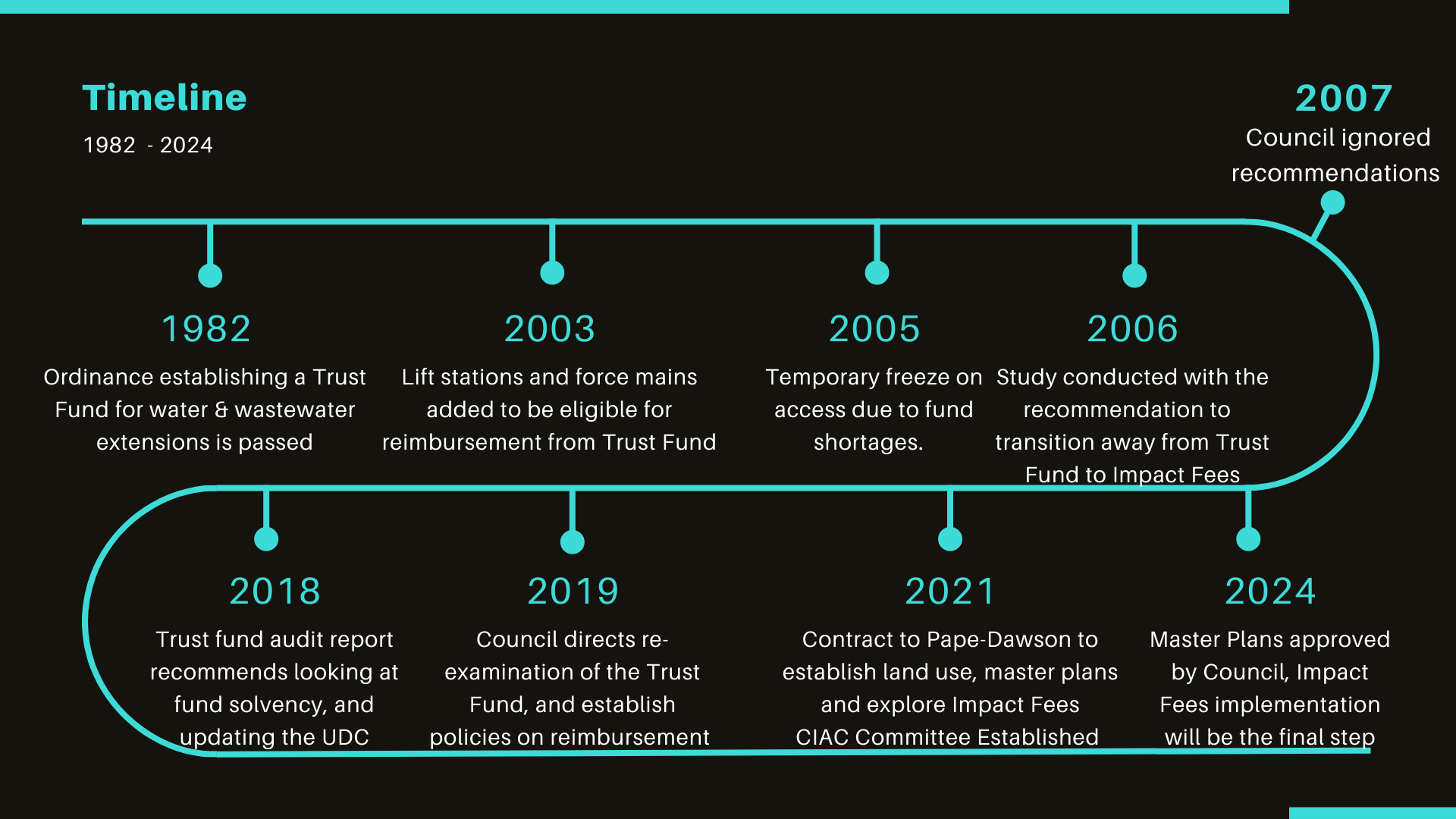

In 1982, the Corpus Christi City Council adopted an ordinance that changed the trajectory of new development to favor the interests of a select few builders and landowners, and it’s still in place today.

Simply put, the trust fund established under the ordinance has led to urban sprawl dictated by developers' interests instead of the city's, all at the taxpayers’ expense.

I learned about the "Trust Fund" ordinance while serving on the city's Capital Improvements Advisory Committee (CIAC).

In 2020, Al Raymond, the former director of development services, told the city’s Planning Commission that disenfranchised taxpayers are an unintended consequence of Corpus Christi's unique trust fund model. The volunteer commission, appointed by the city council, steers the city's development and growth alongside the Development Services Department staff.

"Where development was easier or beneficial for the developer, they developed, and the city, whether (the property) was contiguous (with existing utility infrastructure) or not, they just went there and connected it with infrastructure … there’s a cost to do that when it’s not contiguous, and there’s a maintenance cost associated," Raymond said. "The city is stuck with serving and maintaining that (utility infrastructure) … the current taxpayers are carrying that cost."

The trust fund contributes to rising utility rates and property taxes, and it’s why Corpus Christi is so spread out. The city now covers 160 square miles, compared to similar-sized cities such as Arlington at 95 square miles and McAllen at 55 square miles.

What is the Developer Trust Fund?

Two developer trust funds, water and wastewater, were established under city ordinances in 1982. Since then, they have collected fees from anyone plating or developing property. The fees collected include lot and acreage fees, pro rata fees paid by individuals who request residential meters and taps, or surcharge fees.

The city reimburses developers for out-of-pocket costs by using revenue from the trust funds.

Developers pay out-of-pocket for the utility infrastructure of new developments, such as water and sewage lines, trunk lines, and lift stations.

The trust fund has taken in $39 million in fees between its inception in 1982 and 2022. Currently, billions of dollars in major infrastructure projects are in queue for master plans the city council approved in January 2024.

Trust Fund Flaws

All new developments require drainage and roadway infrastructure in addition to water and wastewater utilities. This means taxpayers are responsible for maintaining that utility infrastructure.

This is the unintended consequence Raymond explained to the Planning Commission in 2020. Essentially, the fees are paid upfront by anyone who plats property, primarily developers. That money goes back into developers’ pockets via trust fund reimbursements instead of contributing to the long-term upkeep of shared infrastructure.

The trust fund model is flawed in two ways, according to Raymond’s report to the Planning Commission:

- It incentivizes new, market-driven developments rather than infill development.

- It forces taxpayers to incur the costs of a growing city alone, with no help from developers.

Consultants have told the city council multiple times that the trust funds have inadvertently shifted the cost burden of the city’s growth onto the taxpayer, but the trust funds remain in place today.

Trust Fund Outcomes

Development in Corpus Christi has been patchy and chaotic, a case of urban sprawl that ignores severe needs for social infrastructure and infill development. The uncontrolled development has stretched most departments beyond their capacity.

It’s becoming common for the trust fund to have financial issues, which create multifaceted hurdles for city staff. The funds are consistently in the red, stifling growth and unnecessarily burdening developers and city efficiency. As of December 2024, the trust funds’ cumulative balance was -$1,899,325, according to a recent inquiry to city staff in the Development Services Department.

The trust fund also has contributed to the west and northside parts of Corpus Christi remaining mostly stagnant in growth or redevelopment. Urban sprawl disenfranchises low-income communities of color from reaching their full potential.

While serving on the CIAC committee, I saw firsthand the hurdles developers and city staff face when accessing and navigating trust funds. Loose rules on who can be reimbursed for projects can work against those who don’t know much about the trust fund and its purpose, especially out-of-town developers.

Recently, the city had to transfer $9.2 million from our shared water and wastewater budget to the developer trust funds because those funds went into debt in 2024. Our water budgets are typically reserved for utility upkeep.

The city had to “bail out” developers – as framed by at-large council member Mike Pusley at the Sept. 10, 2024 City Council meeting. Pusley referred to a trust fund reimbursement as a “trust fund bailout” during the meeting, implying taxpayers are being taken advantage of by developers and the city is aware of it.

Flaws Fall on Deaf Ears

Consultant Duncan Associates recommended in 2007, and again in 2019, that the city adopt impact fees to replace the developer trust fund model because the current model “only serves to reimburse the developer, that’s all it can do,” Raymond told the Planning Commission in 2020.

“Unlike impact fees, where you can do many things, like master plan or maintain water and wastewater facilities,” he added.

The trust fund ordinance language was instead integrated into the city’s Unified Development Code, which was codified in 2011.

The recommendation to end the trust fund model was made after the consultant revealed the model was unsustainable. Duncan Associates also found that the trust funds’ fee revenue should contribute to the costs of initiating and maintaining the city’s growth.

Former Director of Development Services Al Raymond told Chisme Collective that the trust funds were audited in 2018 “because the money collected was not keeping up with the costs of the infrastructure." It prompted changes in how reimbursements are managed and reported to the council.

In 2019, the city council directed Development Services staff to re-examine the developer trust funds shortly after a newly-required biannual report was given to the city council.

In January 2020, Raymond reported to the Planning Commission that the 2019 directive resulted in updated recommendations from consultant Duncan Associates.

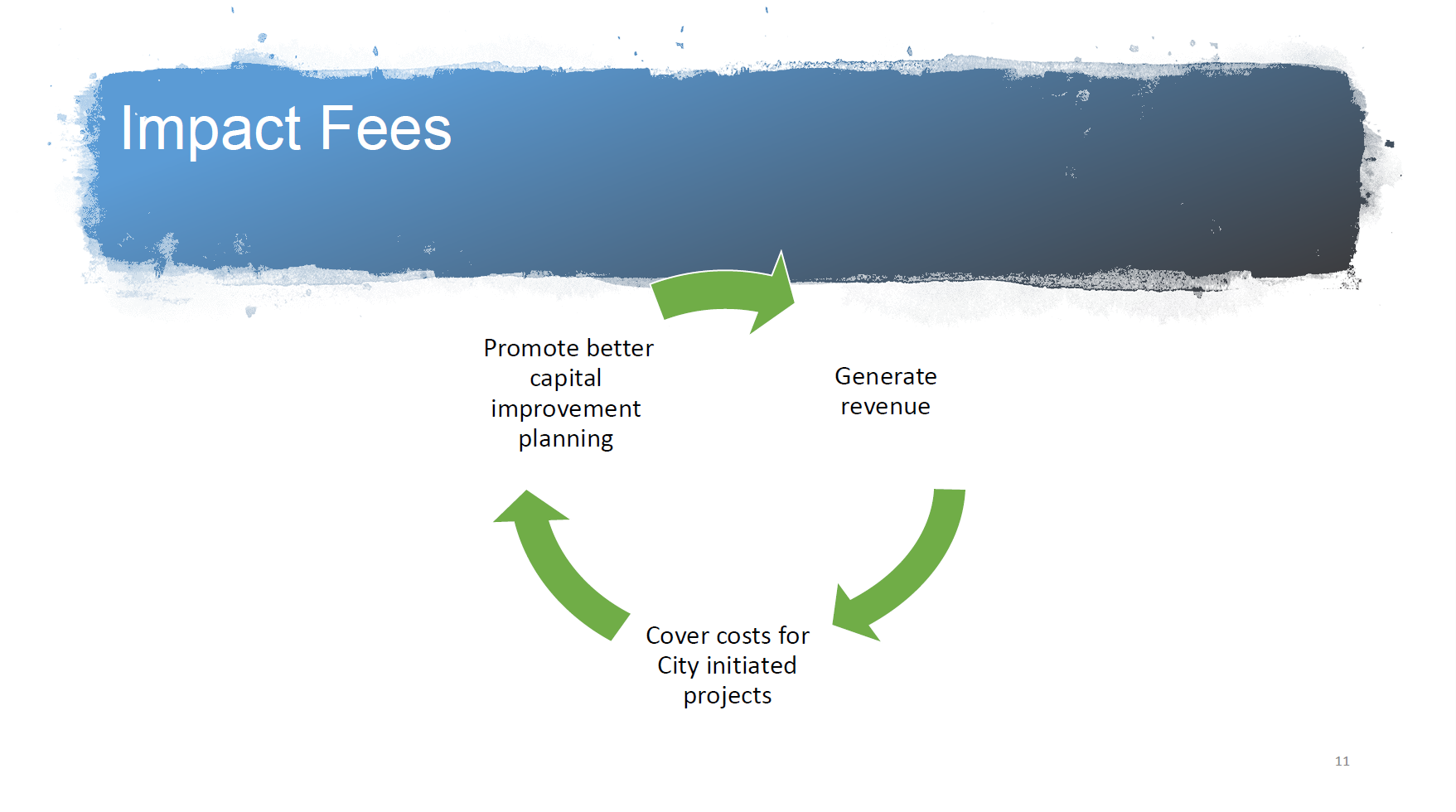

They again recommended that the city do away with the developer trust funds and argued that the proposed impact fee model for developers could do three things the trust funds can’t do:

- Benefit long-term capital improvement planning

- Generate revenue for utility infrastructure

- Cover costs for city-initiated projects

In 2020, the Caller-Times quoted the Duncan Associates’ report stating: “Transitioning to impact fees would support a more comprehensive, planned approach to utility infrastructure expansion, shift more of the costs of growth onto new development, and lower utility rates for existing customers.”

The Capital Improvements Advisory Committee (CIAC) was created shortly after, in 2021. The committee, which I served on from January of 2023 until July 2024, is tasked with exploring impact fees alongside a new consultant, Pape-Dawson Engineers.

In June 2024, the CIAC unanimously recommended that the council transition to an impact fees system. The committee comprises developers, engineers, and several community members outside the industries directly affected.

The item was scheduled to go to the council in July 2024 after more than three years of work by the committee and $4 million spent on consulting services from Pape-Dawson.

However, several council members put politics over the city’s progress. They delayed the vote to transition to impact fees until after the November city council election, which could delay the process well into 2025 or shelve the opportunity as they did in 2007, leaving the trust fund as the only option.

Trust Funds vs Impact Fees

The trust fund model is unique to Corpus Christi; every other Texas city larger than Corpus Christi charges developers impact fees because they’re an industry standard, in addition to being state-regulated and nationally recognized.

Even in some smaller towns like Portland and Port Aransas, developers contribute impact fees to connect to and help maintain existing infrastructure.

Fort Worth has charged its developers impact fees since 1989; it is not a new concept, and many cities of varying sizes have vetted it over decades. Depending on the area and growth patterns, many cities require impact fees for vital water, wastewater, stormwater and roadway infrastructure.

In 1976, Corpus Christi and Austin had the same population. This is an extreme vision of what growing responsibly versus irresponsibly can look like.

Who’s in Charge?

Al Raymond told the Planning Commission in 2020 that the trust fund ordinance was initiated by the development community due to a "perceived lack of leadership" of city staff to develop the city. The development community took the lead, he said.

Impact fees would put the city back into a leadership role, he added.

“It does allow the city to be in a leadership role,” Raymond said of impact fees. “Which I think many would appreciate, once they relinquish the fear that we don’t know what we’re doing.”

Those who were vital in creating the trust fund ordinances are still in positions of power that shape the growth of Corpus Christi and the Coastal Bend.

The trust fund model allows local developers to keep competition out while tax-paying residents pay the costs of new development. Transitioning to impact fees would level the playing field for developers and promote more intelligent growth in Corpus Christi.

We know that in Corpus Christi, the residents subsidize corporations and large-volume water users with inequitable water rates, stormwater fees or industrial district agreements (IDAs).

Impact fees remain stalled due to local developers' control over the current and incoming councils. The true loss to the community is the amount of work and time CIAC members sacrifice and the millions of taxpayer dollars spent on consultants and meetings.

The elite few making these decisions hold the city hostage and manipulate elected officials into thinking they hold power. Some fear change because it will mean they have to pay their fair share of taxes and fees, and they may face more competition from qualified developers from outside the Coastal Bend. Change is only possible when our elected leaders are brave enough to stand up and not bend to corporations or special interest groups.